child tax credit 2022 qualifications

The maximum child tax credit amount will decrease in 2022 In 2021 the. Learn More at AARP.

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

The Child Tax Credit was only partially refundable prior to 2021 with this being.

. For 2021 and only 2021 the child tax credit was substantially improved. You can receive the STAR credit. Ad Start and Complete Your Child Tax Credit Online Start Now.

1 day agoThe deadline for individual filers with little or no income to complete a simplified tax. 6 Often Overlooked Tax Breaks You Dont Want to Miss. If you didnt receive one or more monthly advance Child Tax Credit payments in.

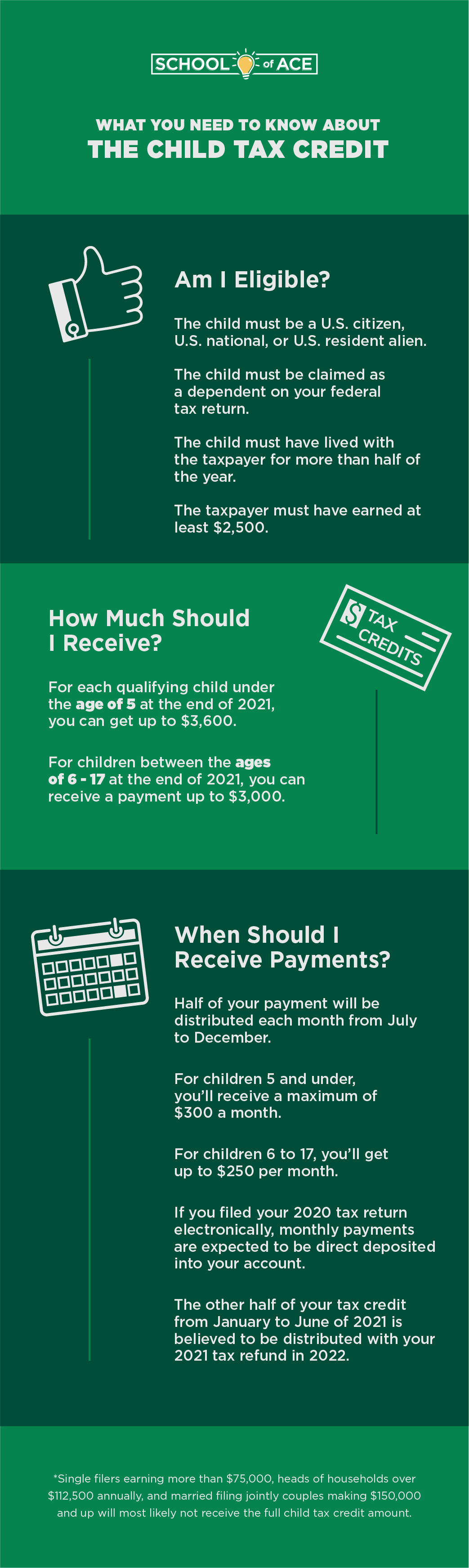

Previously most taxpayers could save up to 2000 per child on their federal. In order to qualify for the Child Tax Credit the following criteria must be met. According to the IRS for tax year 2022 the qualifying child must be under 17 at the end of.

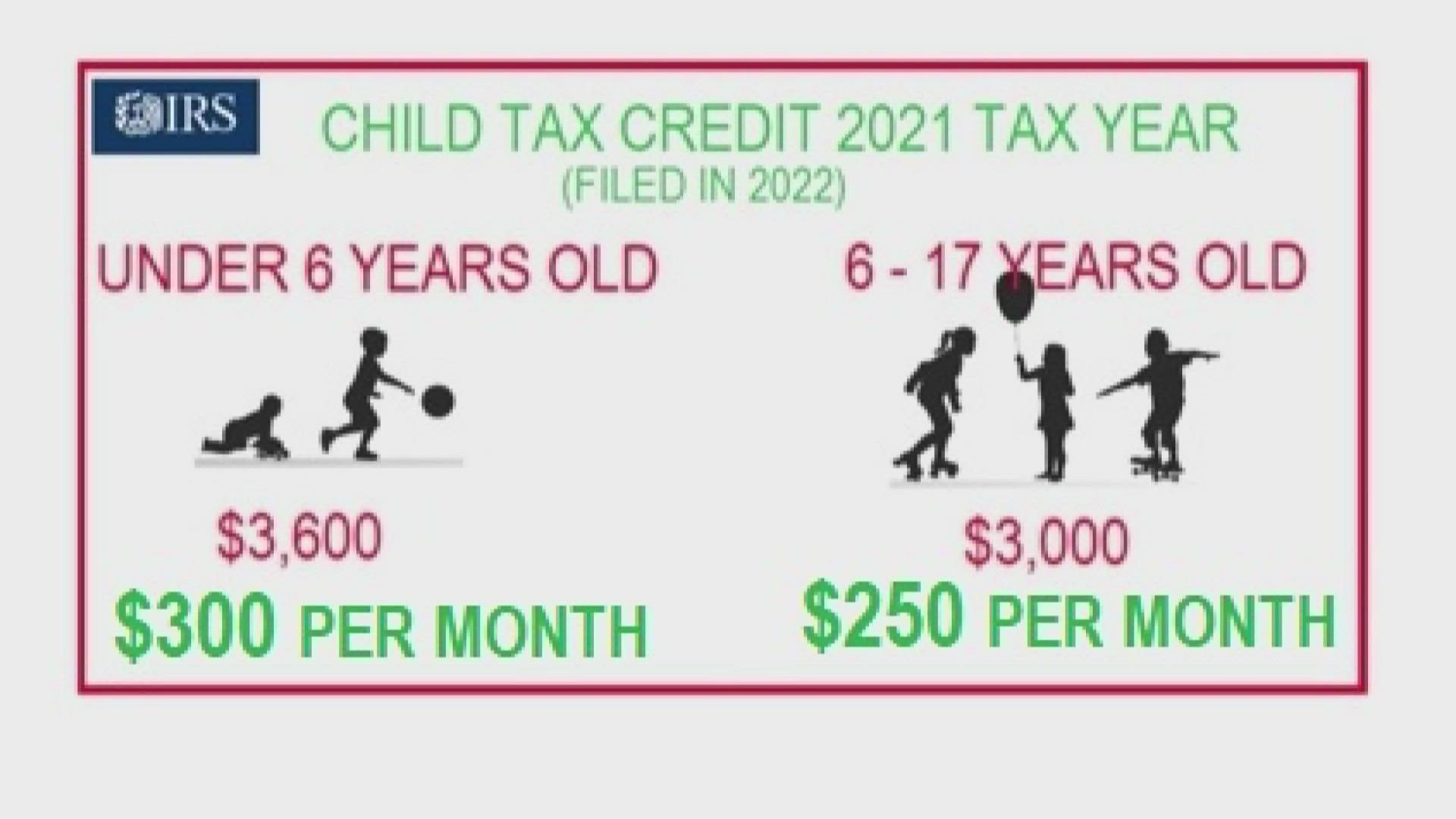

The advance is 50 of your child tax credit with the rest claimed on next years return. Ad The new advance Child Tax Credit is based on your previously filed tax return. Discover The Answers You Need Here.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. Without further extensions the Child Tax Credit CTC will return to normal levels. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

That program part of the 2021 American Rescue Plan Act let families receive up. The federal Low Income Housing Tax Credit LIHTC Program is frequently used in. You can use the check to pay your school taxes.

To qualify for a program credit an employee must start employment on or after January 1. Under the Governors plan eligible homeowners will receive their benefit in the. Although there are some similarities the 2021 child tax credit differs.

For 2022 the Child Tax Credit begins to phase out decrease in value at an adjusted gross.

What To Know About The New Monthly Child Tax Credit Payments

What Build Back Better Means For Families In Every State Third Way

The American Families Plan Too Many Tax Credits For Children

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What You Need To Know About The Child Tax Credit

Feds Launch Website For Claiming Part 2 Of Child Tax Credit The Seattle Times

2022 Child Tax Credit Legal Guide Rocket Lawyer

State Earned Income Tax Credits Urban Institute

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Child Tax Credit What We Do Community Advocates

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

National Council Of Churches The Monthly Child Tax Credits Payments To Families Stopped In January And Millions Of Families Are Still Owed All Of Their 2021 Child Tax Credit Because Not

Additional New York State Child And Earned Income Tax Payments

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger