income tax rate philippines 2021

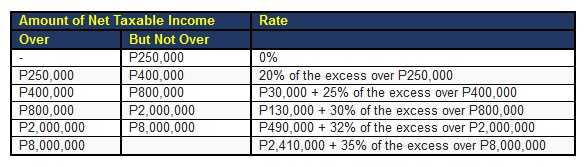

Income Tax Based on Graduated Income Tax Rates. To get the taxable income subtract the OSD from the gross income.

Revised Withholding Tax Table For Compensation

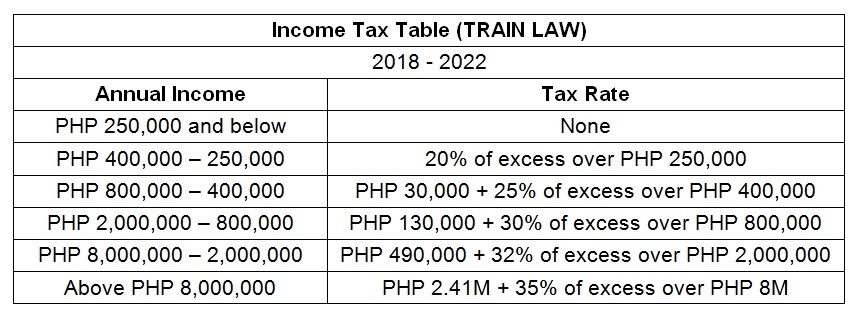

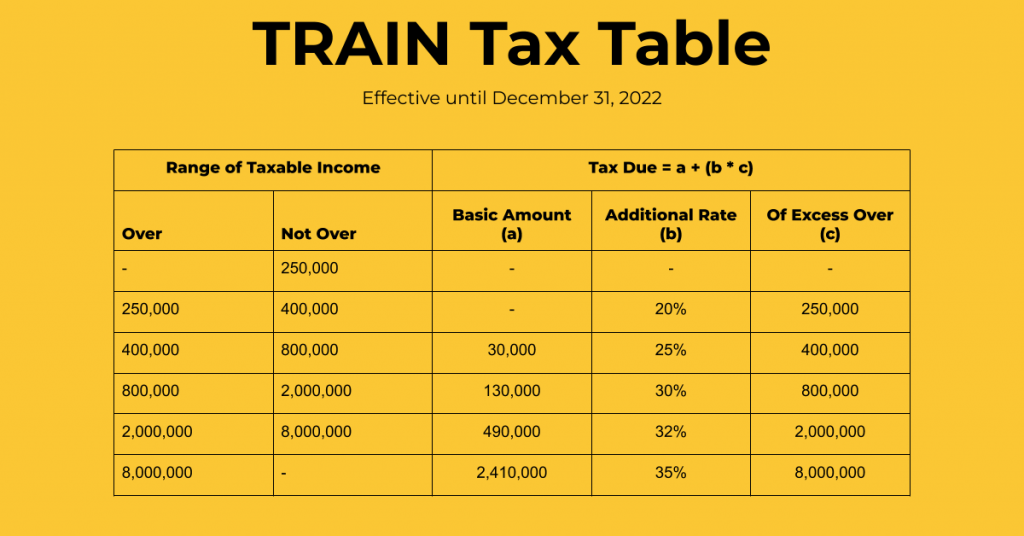

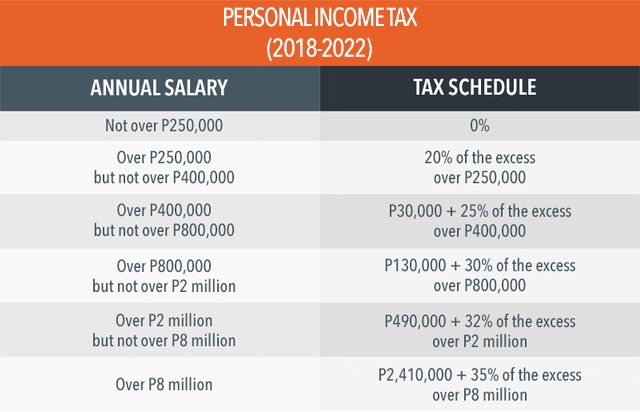

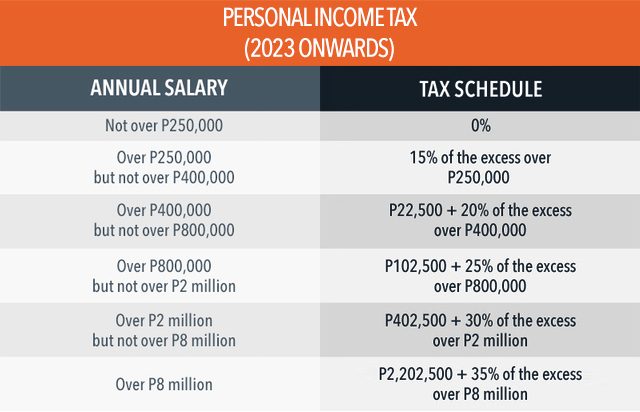

Personal Income Tax Rate in Philippines remained unchanged at 35 in 2021.

. Php 840000 x 040 Php 336000. Implements the provisions on Value-Added Tax VAT and Percentage Tax under RA No. The maximum annual social tax payable by a foreign national employee is PHP 32700 for tax year 2022.

25 for all other domestic corporations and resident foreign corporations eg branches Effective 1 January 2021 the CIT rate is reduced from 30 to 25 for nonresident foreign corporations. Over 250000 - 400000. 11534 Corporate Recovery and Tax Incentives for Enterprises Act or CREATE Act which further amended the NIRC of 1997 as amended as implemented by RR No.

Social taxes consist of contributions to the Social Security System SSS and Philippine Health Insurance Corporation PHIC. In 2021 the 28 percent AMT rate applies to excess AMTI of 199900 for all taxpayers 99950 for married couples filing separate returns. Tax rates for income subject to final tax For resident and non-resident aliens engaged in trade or business in the Philippines the maximum rate on income subject to final tax usually passive investment income is 20.

Determine the standard deduction by multiplying the gross income by 40. Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Philippines. A corporation is resident if it is incorporated in the Philippines or if a foreign corporation ie incorporated.

How many income tax brackets are there in The Philippines. Effective 1 July 2020 until 30 June 2023 the minimum CIT rate is. 11534 Corporate Recovery and Tax Incentives for Enterprises Act or CREATE.

The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35 depending on your income. Php 840000 Php 336000 Php 504000. Implements the new Income Tax rates on the regular income of corporations on certain passive incomes including additional allowable deductions from Gross Income of persons engaged in business or practice of profession pursuant to RA No.

Income Tax Based on Graduated Income Tax Rates. The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more. Foreign nationals who are working in the Philippines are no longer required to contribute to the Home Development.

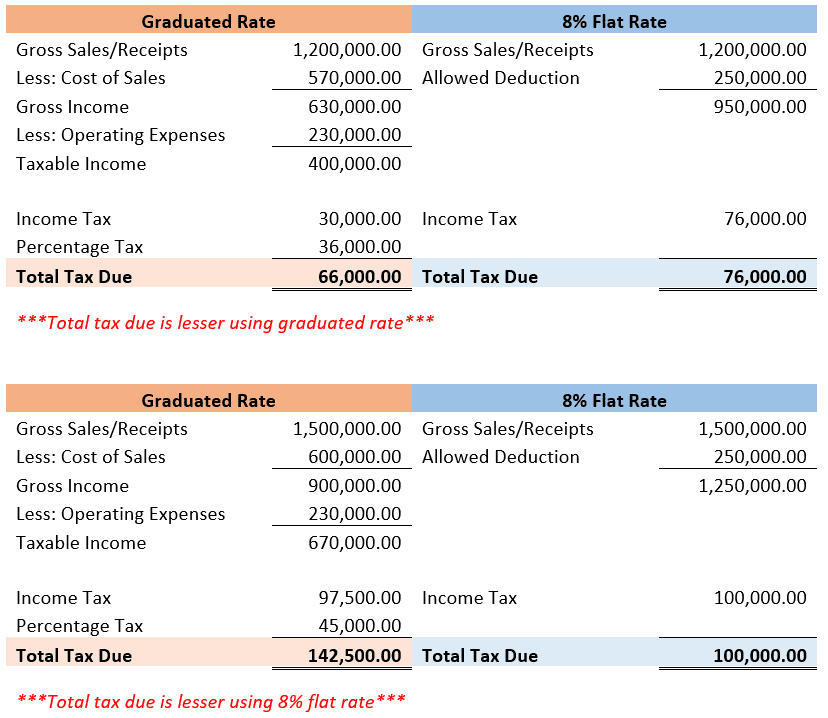

Refer to the BIRs graduated tax table to find the applicable tax rate. The income tax system in The Philippines has 6 different tax brackets. 8 Income Tax on Gross SalesReceipts and Other Non-Operating Income in Lieu of the Graduated Income Tax Rates and the Percentage Tax.

This page provides - Philippines Personal Income Tax Rate - actual values historical data forecast chart statistics economic. Philippine corporations generally are taxed at a rate of 25 as from 1 July 2020 reduced from 30 except for corporations with net taxable income not exceeding PHP 5 million and with total assets not exceeding PHP 100 million which are taxed at a rate of 20. This income tax calculator can help estimate your average income tax rate and your take home pay.

For non-resident aliens not engaged in trade or business in the Philippines the rate is a flat 25. Published in Philippine Star on April 9 2021 Digest. 2021 Alternative Minimum Tax Exemption s.

The Personal Income Tax Rate in Philippines stands at 35 percent. 25 plus 15 tax on after-tax profits remitted to foreign head office. Personal Income Tax Rate in Philippines averaged 3253 percent from 2004 until 2020 reaching an all time high of 35 percent in 2018 and a record low of 32 percent in 2005.

29 rows April 8 2021. If the total Gross SalesReceipts Exceed VAT Threshold of P3000000.

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Revised Withholding Tax Table For Compensation

Comparison For Income Tax Rates Graduated It Rates Vs 8 It Rate

Tax Calculator Philippines 2022

Continue To Enjoy Free Instapay And Pesonet Transactions With Psbank With Its Waive Fees Extended

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Ask The Tax Whiz Can I Still Amend My Itr After The April 18 Deadline

Graduated Income Tax Or 8 Special Tax Which Is Better Accountableph

Tax Basics For Freelancers In The Philippines Upwork Youtube

List Of Taxes In The Philippines For Local And Foreign Companies 2022

Comparison For Income Tax Rates Graduated It Rates Vs 8 It Rate

How To File Your Annual Itr 1701 1701a 1700 Updated For 2021

Tax Calculator Compute Your New Income Tax

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Tax Calculator Compute Your New Income Tax

The Top One Percent Net Worth Levels By Age Group Passive Income Investing Spending Problem

How To Compute Expanded Withholding Tax In The Philippines

Bir Releases Deadline For Filing Of Annual Income Tax Returns

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines